Shipping goods from China to the Amazon FBA warehouse is confusing, especially for sellers who are taking over Amazon sales for the first time. Even experienced Amazon sellers are overwhelmed by the various logistics shipping methods and related regulations, and no matter how scary the various challenges are, a necessary step is necessary.

For FBA destination warehouse import part is more important, because the import side has to deal with the process of transportation, customs clearance, delivery, etc.. No matter how difficult it may seem, this is a basic essential process.

Every FBA operator has the same goal, to select their own hot products, deliver them to the FBA warehouse intact, and use the lowest cost logistics solution possible.

Part 1. Shipping methods to Amazon FBA

- Air Freight

- Sea Freight

- International Express

Part 2. Calculated weight rules for three types of logistics

Part 3. Characteristics of the three types of logistics

Part 4. How to choose between DDP (Delivery Duty Paid) and DDU (Delivery Duty Unpaid) in Amazon FBA?

- The difference between DDP and DDU

- How to choose the most economical?

- Documents to be prepared

- Items easily detained during customs clearance

- What are the ways to insure Amazon FBA customers?

- How is the FBA headway insurance premium calculated?

Part 7. How to develop a reasonable logistics solution?

Part 8. What Amazon FBA services do we offer?

- Standard Service

- Value Added Services

- Return Service

Part 1. Shipping methods to Amazon FBA

- Air Freight

Air freight refers to a freight logistics method in which the freight forwarder directly airlifts the goods to the destination country, and then the freight forwarder cooperates with the delivery organization in the destination country as an agent to deliver them. Air freight is faster, but also more expensive. It is very good for stock preparation and replenishment during the peak season of e-commerce.

- Sea Freight

Sea freight relative to air freight is much more cost-effective, so many Amazon merchants are accustomed to choose sea freight. However, sea freight is affected by natural weather and other aspects of logistics time, resulting in a longer delivery time. The shipping transport has a large volume, and since it is sailing on the big sea, there is basically no need to consider the restriction caused by the weight of the cargo. You can choose either FCL (Full Container Load) or LCL (less than container load) for shipping your cargo. The most important feature of sea freight is the cheap price, large volume and safety of cargo, which is suitable for replenishment of goods without urgency.

- International Express

DHL,FEDEX,UPS, this way is faster and flexible, but Amazon does not exist as a recipient, and the goods are sent directly to the location of the Amazon warehouse without a recipient. The question arises: what if the goods have problems at the destination customs, and who should handle them? Can not find someone to deal with, the goods will face the dilemma of being returned, the cost of returning that is quite high.

Part 2. Calculated weight rules for three types of logistics

To understand the rules for calculating weight, you need to know what is the actual weight, the volumetric weight, and the chargeable weight.

1. Actual weight

Actual Weight, based on the weight obtained by weighing, includes actual Gross Weight (G.W.) and actual Net Weight (N.W.). The most common is the actual gross weight.

In air cargo transportation, the actual gross weight is often compared with the calculated volumetric weight, and whichever is greater is calculated and charged for freight.

2. Volume weight

Volume weight, according to a certain conversion factor or calculation formula, the weight calculated by the volume of goods.

In air cargo transportation, the conversion factor for calculating the volumetric weight is generally 1:167, that is, a cubic meter is equal to 167 kg.

For example: the actual gross weight of an air cargo is 95 kg, the volume is 1.2 cubic meters, according to the air cargo 1:167 coefficient, the volume weight of this ticket is 1.2 * 167 = 200.4 kg, which is greater than the actual gross weight of 95 kg, so this cargo is bubble cargo (also called throwing cargo, light cargo, the English name Light Weight Cargo or Light Cargo or Low Density Cargo or Measurement Cargo), the airline will bill according to the volume weight, not the actual gross weight. Please note that air freight is generally called bubble cargo, and sea freight is generally called light cargo, which is called differently.

Another example: the actual gross weight of an air cargo is 560 kg, the volume is 1.5 CBM, according to the air cargo 1:167 coefficient, the volume weight of this ticket is 1.5 * 167 = 250.5 kg, less than the actual gross weight of 560 kg, so this cargo is heavy cargo (English called Dead Weight Cargo or Heavy Cargo or High Density Cargo), the airline will bill according to the actual gross weight, not the volume weight.

In short, according to a certain conversion factor, the volume weight is calculated, and then the volume weight is compared with the actual weight, and whichever is greater is charged according to that.

3. Chargeable weight

Chargeable Weight, or C.W., is the weight by which freight or other miscellaneous charges are calculated.

The chargeable weight is either the actual gross weight or the volumetric weight. The chargeable weight = actual weight VS volumetric weight, whichever is greater, is the weight used to calculate the transportation cost.

4. Calculation method

Calculation of air transport: Length (cm) × width (cm) × height (cm) ÷ 6000 = volume weight (KG), that is, 1CBM ≈ 166.66667KG.

Calculation of international express: Length (cm) × width (cm) × height (cm) ÷ 5000 = volume weight (KG), that is, 1CBM = 200KG.

Calculation of sea freight: For sea freight LCL, it is usually calculated according to length (cm) × width (cm) × height (cm) ÷ 6000 = volume weight (KG) or by volume (CBM).

Part 3. Characteristics of the three types of logistics

- Air Freight and International Express

Air freight and international express are suitable for fast replenishment of hot products on Amazon.

Advantages: FBA air freight is always a fast and reliable option. In addition, sellers can choose international express, which can make shipping faster, but will also cost more.

Disadvantages: FBA air freight and international express are costly and have space restrictions for large shipments. There are stricter freight regulations. Usually international express requires the recipient to be responsible for customs clearance, and freight forwarders are not responsible for customs clearance.

- Sea Freight

Sea freight is affordable and suitable for transporting large quantities of goods.

Advantages: More cost effective and greater shipping capacity.

Disadvantages: Sea freight is slow and may be affected by sudden climate changes.

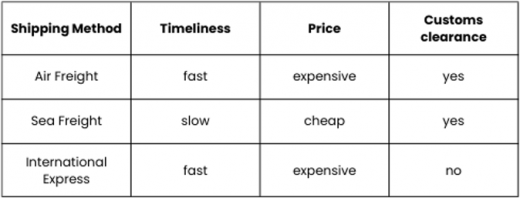

The chart below will help you quickly understand the characteristics of the three logistics methods.

Part 4. How to choose between DDP (Delivery Duty Paid) and DDU (Delivery Duty Unpaid) in Amazon FBA?

- The difference between DDP and DDU

Delivered Duty Paid (DDP) is a one-stop service derived from freight forwarder to solve the tedious process of seller’s shipment. Duty paid service means that freight forwarder is responsible for arranging trailers, customs clearance, ship allocation, transportation, etc. All costs are included in the price of duty paid, including all costs arising from customs clearance in the exporting country and the destination country.

Delivery Duty Unpaid (DDU) is the delivery of cleared goods to the specified destination within the specified time, delivered by transport and assuming the costs and risks prior to delivery (excluding customs duties and other official charges payable at the time of import).

- How to choose the most economical?

DDP is generally more expensive than DDU because the freight forwarder is packing up all the costs and handing them over to the seller. the price of DDP will be higher, but for the seller, the one-stop service will also save a lot of work!

But sellers with customs clearance strength, they are also free to choose DDU channel. There are some goods that can be tax deductible and others that can get a discount. Sellers can all choose by comparing the trade-offs.

Part 5. Customs clearance

Customs clearance means that imported goods, exported goods or transshipment goods entering the customs or territory of a country must declare to the customs, carry out the formalities stipulated by the customs and fulfill the obligations stipulated by the laws and regulations!

- Documents to be prepared

- Customs declaration

- Commercial Invoice

- Customs Declaration Power of Attorney

- Purchasing Contract

- Bill of Lading

- Packing List

- Fumigation certificate (in the case of wooden pallets) If it involves permits, commodity inspection, you also need to provide the relevant certificates

- Items easily detained during customs clearance

- Anti-dumping products: Usually, sellers declare anti-dumping products on commercial invoices, 90% of which will be held up in customs.

- Special products: usually such as glasses, beauty equipment, medical devices, etc.. These products generally require special certification, such as: European countries need CE certificate, the United States need FDA certification.

- Low declaration of goods: for example, German customs strictly check low-declaration goods.

Part 6. Insurance

In the process of Amazon FBA headway shipping, it is inevitable that accidents will occur. For example, the goods are lost in transit, and the goods are not put on the shelves for a long time after being put into the warehouse, resulting in different degrees of losses. These risks can be claimed through insurance. Many FBA headway insurance can be insured and FBA shelves.

- What are the ways to insure Amazon FBA customers?

- Customers buy their own insurance: After sailing, we will provide the name of the vessel, container number or SO to purchase logistics insurance by the customer.

- Freight forwarding company to buy insurance on behalf of: Submit the insurance information as required by the freight forwarder and have the freight forwarder purchase the insurance on your behalf.

- How is the FBA headway insurance premium calculated?

The insurance premium is calculated according to the value of the goods, generally 3‰-5‰. Calculation formula:

- Insurance premium = Insurance amount * Insurance rate

- Insurance amount = CIF invoice price (CIF price) * invoice mark-up rate (generally 10% mark-up) = CIF price * 110%

Insurance amount: please insure according to the actual value of goods, the insurance amount is equal to or close to 110% of the declared value. fba headway insurance has a minimum limit, not set the less the amount of insurance premium will be lower. And if the insured amount is low, the amount of payout may be very little or the policy will be invalid. If the insured amount is declared too high, not only will it be a waste of money, or the possibility of fraudulent insurance. Thus losing the utility of the insurance, so the insurance by 110% of the declared value of goods is more reasonable.

Part 7. How to develop a reasonable logistics solution?

Firstly, the seller should not only consider the timeliness when choosing the FBA headway service transportation method, but also combine their own capital turnover to reduce the cost.

Secondly, in addition to the choice of shipping method, the seller should also consider the weight of the goods when choosing the goods. If the volume of goods is large, the seller should consider shipping combined with heavy goods to avoid additional freight costs due to the large volume.

Third, it is recommended to try to use multiple shipping methods at the same time to ensure that our products can be kept in stock and continue to bring us revenue and profit, while reducing shipping costs.

Fourth, before sending FBA headway, the seller must understand the policies and barriers of the country where the chosen FBA warehouse is located in order to be fully prepared for the first FBA shipment.

Finally, it is recommended to use the FBA headway service of the third-party logistics company: the third-party logistics company provides the consignee and contact information, so as to avoid the biggest problem of sending the express directly, and someone will come forward to deal with the problem of the goods to assist in customs clearance or pay the customs duty on behalf of the seller. In addition, for the goods label is not clear or does not meet the requirements, resulting in the smooth entry into the Amazon warehouse, the logistics company can also help customers to print Amazon labels, labeling on behalf of the customer, and shipped to the Amazon warehouse.

Part 8. What Amazon FBA services do we offer?

1. Standard Service

Air and sea freight services from China to Amazon warehouses in USA, Canada, Europe, Australia, Mexico. Includes: shipping, customs clearance, insurance.

- Air Freight to USA Amazon FBA

- Sea Freight to USA Amazon FBA

- Air Freight to Canada Amazon FBA

- Sea Freight to Canada Amazon FBA

- Air Freight to Europe Amazon FBA

- Sea Freight to Europe Amazon FBA

- Air Freight to Australia Amazon FBA

- Sea Freight to Australia Amazon FBA

- Air Freight to Mexico Amazon FBA

- Sea Freight to Mexico Amazon FBA

2. Value Added Services

- Print Amazon labels: Print the corresponding labels for each product in accordance with Amazon FBA barcode content requirements

- Labeling: In accordance with the requirements of Amazon FBA into the warehouse, each product is labeled with the corresponding barcode

- Sorting: according to Amazon FBA into the warehouse product type and quantity requirements, sorting by box packaging

3. Return Service

We can provide our overseas warehouse address and assist in handling returned shipments from Amazon warehouses. Help customers to re-operate the shipment to re-send into the warehouse or other processing.

FAQ

Amazon to improve the buyer experience for sellers to provide goods sent to the Amazon warehouse, and then shipped a shipping model. Only goods that have completed customs clearance are accepted into the warehouse, and the goods have no relationship with Amazon before entering the Amazon FBA warehouse.

So Amazon does not act as the importer of goods, does not bear all the costs of goods due to import customs clearance and import tariffs, etc. If the tariffs arise in the import process Amazon is no actual recipient to deal with.

So in order to avoid the risk of returns, the courier companies will recommend doing DDP (tariffs are prepaid by the sender) or using a third-party customs clearance agent as the actual consignee.

There are two kinds of labels, one is the product label, affixed to the outside of each product, and there is an outer box label, affixed to the outermost box, Amazon scanning without opening the box can be scanned.

The four small boxes are labeled with SKU barcodes, and the outer boxes are labeled with FBA barcodes.

The product label will not change, you can compare the FNSKU code on the barcode, are unchanged.